My Quick Loan merge with Risk and Forecast

The CEO of My Quick Loan Ned Priestly, is proud to announce that riskandforecast.com is now part of my-quickloan.co.uk.

Riskandforecast was built to show the risks in the finance industry, in particular the loan industry.

Ned said “Here at My Quick Loan, we know our industry can be very risky and our customers often get caught in the quick loans cycle. We thought it would make perfect sense to purchase Risk & Forecast to highlight the risk involved to our customers.”

The team at My Quick Loan believes we can grow the risk section on our site, to really help customers understand the payday loan industry and what risks are involved when taking a loan out.

We forecast that the number of instant loans will increase this year due to the cost of living and inflation raising significantly. It certainly will be unnerving times for a lot of UK households. Please follow our risk and forecast section where we will:

- Highlight the risk of taking out loans.

- Risk of lenders like Quickquid going into administration.

- Show how to forecast budgeting.

- Forecast your finances to help you save money.

- Teach you the risk of being in bad credit.

- Risk of taking Christmas loans out.

Ned finished with “We are super excited to continue the Risk & Forecast Journey here at My Quick Loan. We will also look at purchasing our next company soon and continue to help grow MQL to where it needs to be“.

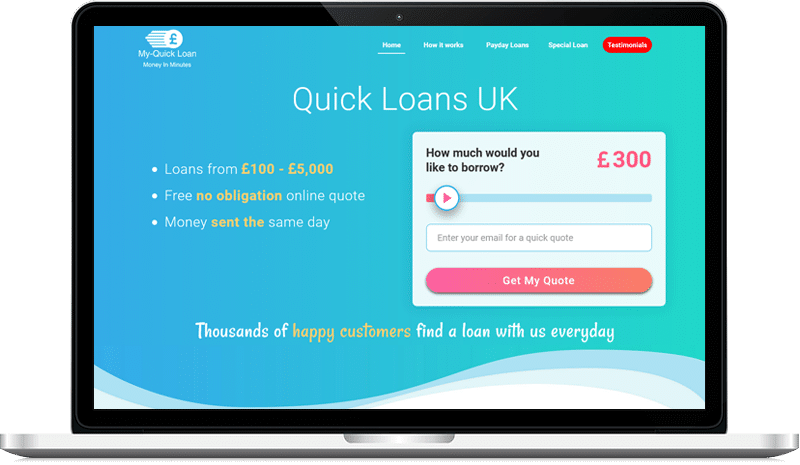

Get your free loan quote today

Access from £100 to £5,000